philadelphia wage tax calculator

The tax is 45 for direct descendants children grandchildren etc 12 for siblings and 15. There is no tax on transfers to a surviving spouse or to a parent from a child aged 21 or younger.

Salary Paycheck Calculator How Do You Calculate Your Take Home Pay Marca

The Philadelphia City Wage Tax is a tax on earnings applied to payments that an individual receives from an employer for work or services.

. For questions about City tax refunds you can contact the Department of Revenue by emailing the Tax Refund Unit or calling any of the following phone numbers. Ad See If You Qualify For IRS Fresh Start Program. Ad See If You Qualify For IRS Fresh Start Program.

In the state of california the new wage tax rate is 38398. We Help Taxpayers Get Relief From IRS Back Taxes. The Wage and Earnings Tax rates will be 34481 percent for non-residents and they will be 34481 percent for.

Get Your Max 2021 Tax Refund. The new non-resident rates will be a flat 344 for Wage Tax and 344 for Earnings Tax they were previously 34481. Philadelphia Wage Tax Calculator.

The information provided by the Paycheck. Rates for 2022 range from 12905 to 9933 with new employers responsible for a rate of 3689. Updated for 2022 tax year.

Ad Calculate your tax refund and file your federal taxes for free. The Pennsylvania Salary Calculator. Ad Calculate your tax refund and file your federal taxes for free.

38809 for Philadelphia residents 34567 for non-residents. If you work in construction you are expected to pay 102238 for 2022. Tax rate for nonresidents who work in Philadelphia.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Residents of philadelphia pay a flat city income tax of 393 on earned income in addition to the. For example as of July 1 2019 you must withhold 38712 of earnings for employees who live in Philadelphia.

SmartAssets Pennsylvania paycheck calculator shows your hourly and salary income after federal. Calculate your take home pay after federal Pennsylvania taxes deductions and exemptions. Free Case Review Begin Online.

Pennsylvania income tax calculator. Just enter the wages tax withholdings and other information. 2021 Tax Calculator Free Online.

Free Case Review Begin Online. Philadelphia wage tax calculator Sunday May 22 2022 Edit The median household income is 59195 2017. Use ADPs Pennsylvania Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

We Help Taxpayers Get Relief From IRS Back Taxes. For annual and hourly wages. Get Your Max 2021 Tax Refund.

Workers can change their tax status and be exempt from the city of philadelphias city wage tax of 34481 until june 30 2020 and 35019 beginning. Employers must begin withholding Wage Tax at the new. The new rates are as.

See where that hard-earned money goes - Federal Income Tax Social Security. Updated for 2022 tax year. You must withhold 38712 of earnings for employees who live in.

How to use bir tax calculator 2022. Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and. Calculating your pennsylvania state income tax is similar to the steps we listed on our federal paycheck calculator.

Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident and non-resident taxpayers alike. The new rates are as follows. Philadelphia Wage Tax For example Philadelphia charges a local wage tax on both residents and non-residents.

2021 Tax Calculator Free Online. What is the Philadelphia city wage tax for non-residents. The City of Philadelphias tax rate schedule since 1952.

Car Tax By State Usa Manual Car Sales Tax Calculator

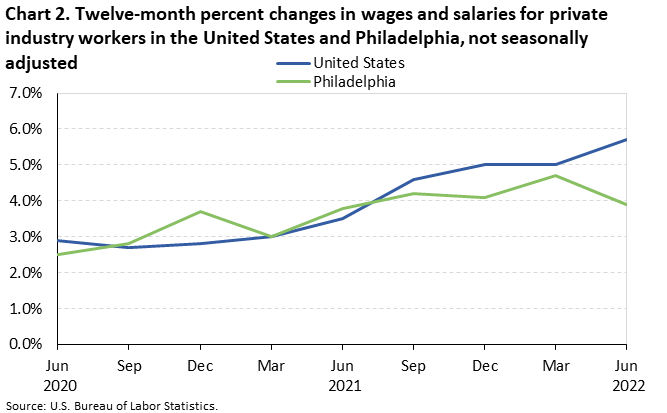

Changing Compensation Costs In The Philadelphia Metropolitan Area June 2022 Mid Atlantic Information Office U S Bureau Of Labor Statistics

Pennsylvania Paycheck Calculator Smartasset

Philadelphia Income Tax Preparation Planning For Individuals Business

Commercial Income Tax Services Philadelphia

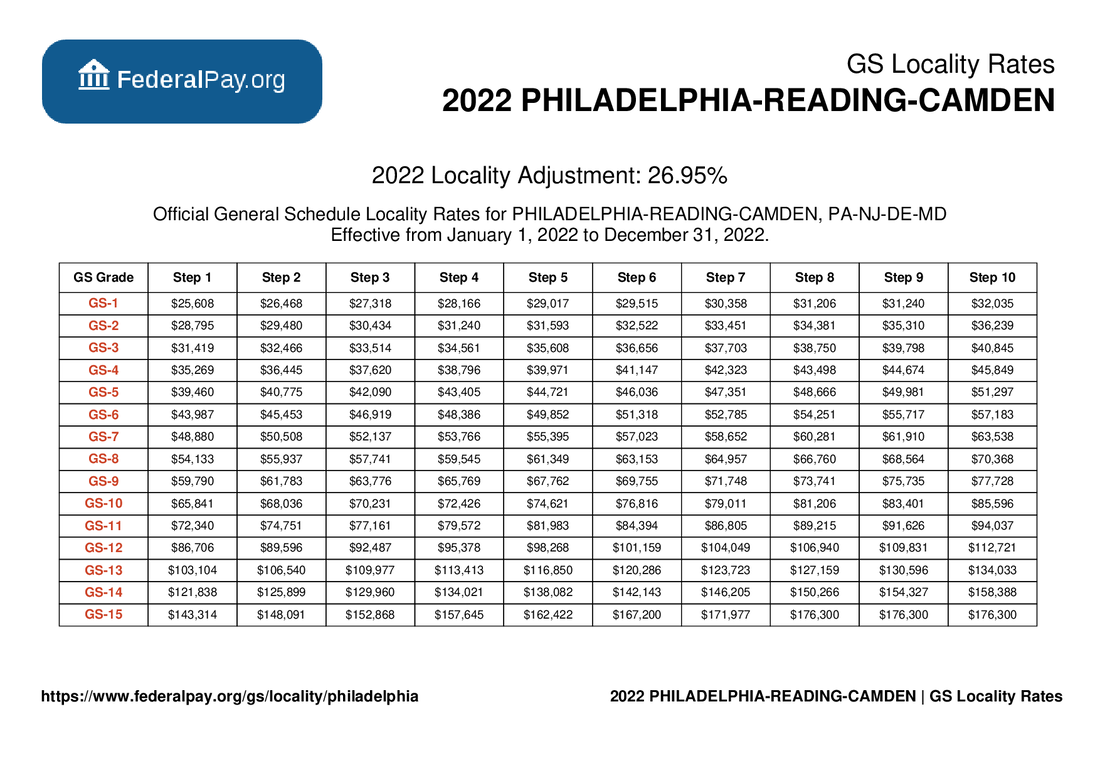

Philadelphia Pay Locality General Schedule Pay Areas

New Tax Law Take Home Pay Calculator For 75 000 Salary

Employment Taxes 101 An Owner S Guide To Payroll Taxes

3rd Stimulus Check How Much Will I Get When Use This Calculator Syracuse Com

Pennsylvania Income Tax Calculator Smartasset

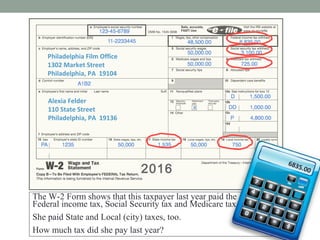

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

![]()

Pennsylvania Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Chicago Vs Philadelphia Comparison Cost Of Living Salary

Free Tax Preparation Northeast Times

Haven T Received Your Tax Refund Yet It Could Still Be Awhile Fox School Of Business

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog